The convenience involved in availing a personal loan is undeniable. Moreover, the loan amount could be availed to meet any need which makes a personal loan one of the preferred loan options when in an emergency or any need.

Many times, you might have received offers from your bank or credit card companies offering you a pre-approved personal loan offer and you might have wondered if it worth accepting the offer and the advantages and disadvantages of such an offer.

This article aims to answer all your questions regarding pre-approved personal loans.

What are Pre-Approved Personal Loans?

Pre-approved personal loans are loans that have already been approved by the lender based on the details of the borrower available. Like any other personal loan, pre-approved personal loans are also unsecured and collateral-free loans.

However, the main difference here is unlike a normal personal loan where the borrower applies for a loan, the pre-approved offer is made by the lender mainly based on good credit score and other responsible credit habits like prompt repayment of earlier and existing loans, spending habits, average balance maintained in the account, etc.

These could be offered by banks, credit card issuers, non-banking financial institutions or even fintech lenders.

Who is Eligible for Pre-Approved Personal Loans?

The lender makes the choice of individuals for pre-approved personal loans, after being satisfied with the creditworthiness of the borrower from their existing customers based on various criteria like

- A good credit score

- Excellent Repayment History on Previous Loans

- A long-standing good relationship with the lender

- More than average balance maintained in the account on a continuous basis

- A good and steady source of income

What is the Process Involved in Pre-Approved Personal Loan?

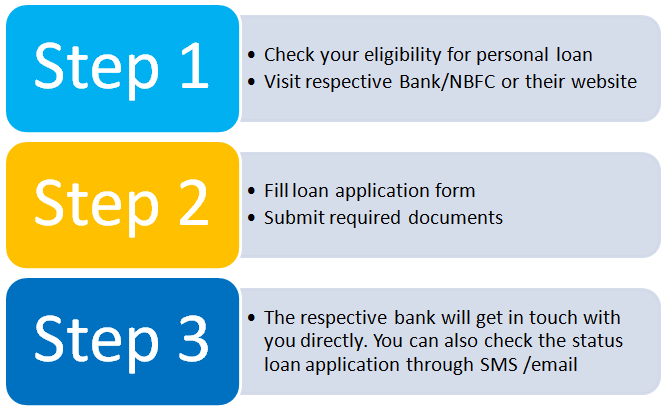

Though the loan is approved before offering it to the borrower, there might be a short process involved in getting the loan disbursed.

This can often differ between the lenders.

The normal process involved in availing a pre-approved personal is

- Acceptance of the Offer: The most important thing when you receive a pre-approved offer is that you accept the offer at the earliest as pre-approved offers are time-bound. The acceptance could be done by either by logging on to your Net-banking account or by clicking on the Accept Offer button that comes on the email or by calling the Call Centre Number to avail the loan offer.

- Submission of Documents (If Required): Certain loans may require resubmission of documents to ensure that the details available with the bank/lender have not changed. At the same time, certain banks may allow you to avail of the offer without submitting the documents again.

- Subsequent Re-approval and Disbursal: If the process required resubmission of documents, it might be compared against the data on which the pre-approval was given. If there has been a lot of difference in the eligibility criteria like a sharp drop in a credit score or in income, etc, then the loan might not be eventually approved.

If everything is in order, then the loan may be disbursed.

Advantages and Disadvantages of Pre-approved Loans

Though on the surface, it may look like everything associated with a pre-approved loan is ideal, it is good to look at the advantages and disadvantages associated with pre-approved personal loans.

Advantages of a Pre-approved Personal Loan

- Works Well for Immediate Cash needs: If your need for cash is immediate, a pre-approved loan can come in as a savior due to the ease involved in the process. Certain banks allow loans based on your credit card too, which is over and above your credit limit. These offers prove very useful at times.

- Much Easier Process than a usual Personal Loan: Pre-approved offers involve a much easier process of availing a personal loan; hence it involves lesser hassles especially when it does not involve the submission of additional documents.

- Comparable Interest Rates: Often, pre-approved personal loans come with a comparable interest rate as with other personal loans. So, you end up getting a personal loan with all the benefits at a similar rate of interest as a normal personal loan.

Disadvantages of a Pre-Approved Personal loan

- Time-Bound Offer: Pre-approved offers are time-bound. That is, they generally come with an expiry date, so you would need to avail of the loan within that time frame or the offer lapses.

- Don’t get it when you need it: These loan offers are not always available when you need. Therefore, they may not prove to be very useful if these offers are sent to you when you are not in need of a loan. On the contrary, these loans may tempt you avail of a loan when you don’t need one.

- May Involve Unfavorable Terms and Conditions: As these offers are given pro-actively by the lender, they may involve unfavorable terms and conditions, like higher pre-payment penalty or a higher than usual rate of interest.

It is difficult to categorize pre-approved personal loan offers as good or bad. So, it is necessary that as a user, you look at all the terms and conditions, including the rate of interest associated with the offer before availing the offer. Also, borrow only when you are in need and only as much as you can comfortably repay.